Pre-Retirees & Retirees

Thinking about Retirement, an exciting yet sometimes scary proposition.

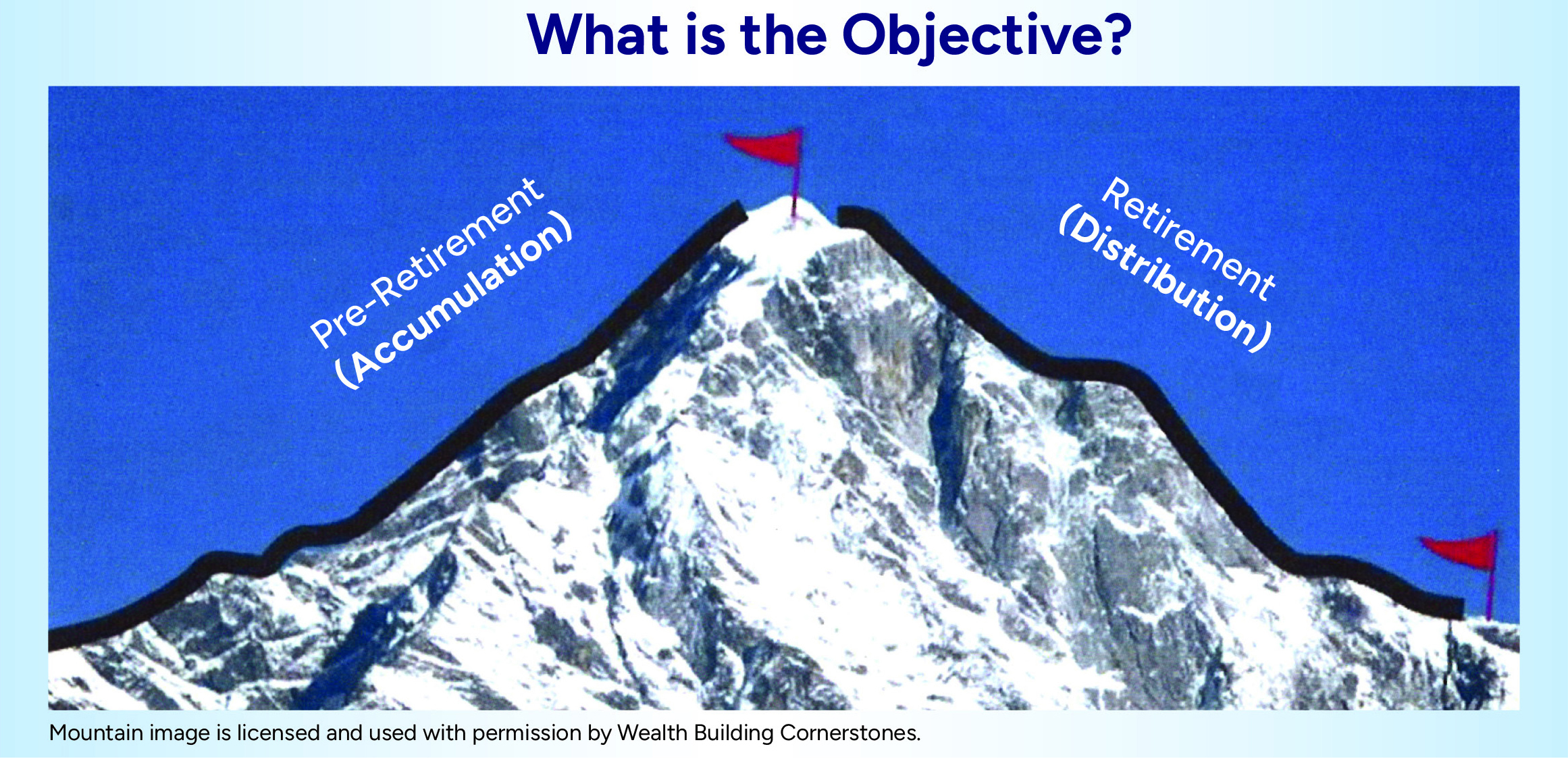

The Objective is…

not only to Accumulate enough in Pre-Retirement but also, to have enough income in Retirement without the fear of running out of money.

Think of it like climbing a mountain. The goal is to not only make it to the top of the mountain but to make it back down safely.

Getting up the mountain is the Pre- Retirement (Accumulation) phase and getting down is the Retirement (Distribution) phase.

The Retirement Savings Dilemma

Watch the video below to understand how a holistic approach to retirement can benefit you.

WHO WE SERVE

Our clients love their families and desire to make a difference in the lives of others. They want to guarantee that they are financially secure and that their families can share in their success.

There are 2 rates that make up everyone’s Retirement Income and both are equally important.

1. Accumulation Rate: how fast you accumulate money going up the mountain.

2. Distribution Rate: how fast you can distribute money from the assets that you have built without running out on the way down the mountain.

Financial research recommends only withdrawing 3-4% from retirement assets to avoid running out of money. This would mean a $1M account would only produce $30-40,000 of annual income. To produce $150,000 would require $3.75-5M.

For many people the problem isn’t accumulation of money for retirement but rather the low distribution rate. This is especially true for people who want to replace their current income in Retirement and continue to live the lifestyle that they are

accustomed to.

Why Choose Rocky Mountain Financial Services?

Our accomplished team brings together a rich blend of experience, expertise, and resources to adeptly address the financial hurdles encountered. Through providing impartial, objective guidance, we enable you to make astute financial choices, free from the influence of emotional biases.

Start Now

Ready to start feeling more confident about your finances and living your life to the fullest?

Let’s Turn Your Financial Dreams Into Reality.

"*" indicates required fields